Introduction

Decentralized Finance (DeFi) has emerged as one of the most revolutionary developments in the cryptocurrency space, offering a vast array of financial services without the need for intermediaries. As the DeFi ecosystem continues to grow, a fascinating trend is emerging: centralized exchanges, once seen as competitors to DeFi platforms, are now evolving to become crucial gateways for accessing DeFi services. This article explores the symbiotic relationship between centralized exchanges and DeFi, highlighting the benefits and challenges this convergence brings to the broader crypto landscape.

The Rise of DeFi

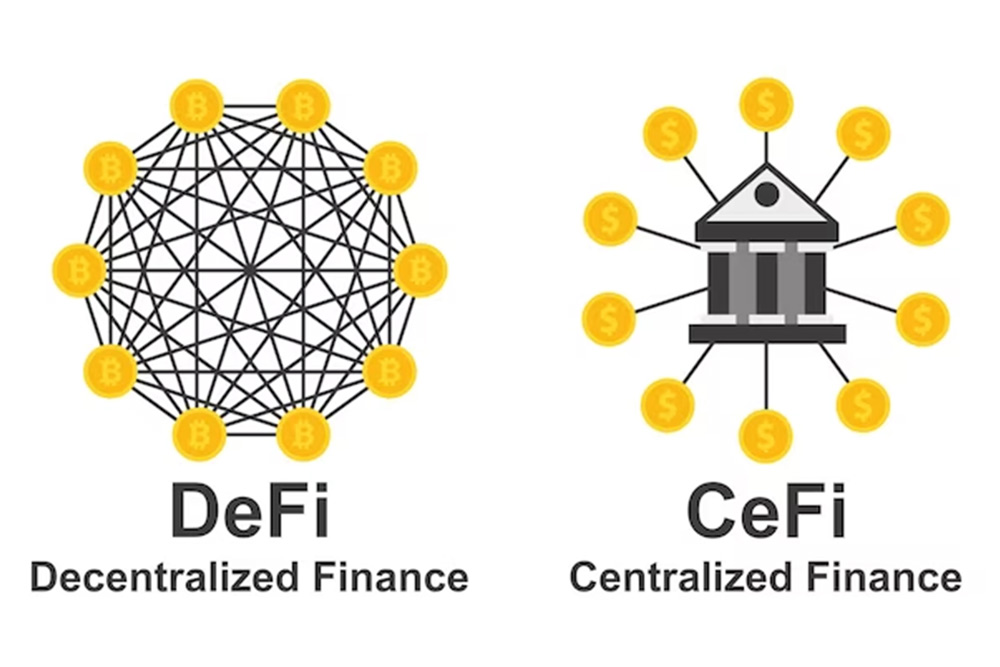

DeFi has rapidly gained traction over the past few years, transforming how users access financial services. Built on smart contracts and blockchain technology, DeFi platforms enable activities such as lending, borrowing, trading, yield farming, and more, all while maintaining complete control of assets without the need for intermediaries like banks.

The appeal of DeFi lies in its openness, accessibility, and inclusivity, offering financial services to anyone with an internet connection. The industry’s total value locked (TVL) has soared to billions of dollars, and a myriad of decentralized applications (dApps) continues to proliferate within the DeFi ecosystem.

Centralized Exchanges as On-Ramps

Centralized exchanges (CEXs) have been the primary entry points for most individuals looking to buy, sell, and trade cryptocurrencies. They provide user-friendly interfaces, liquidity, and regulatory compliance, making them a trusted and convenient choice for newcomers and seasoned investors alike.

As the DeFi space gains popularity, centralized exchanges recognize the potential of this booming market. To capitalize on this opportunity, CEXs are transforming into gateways that facilitate access to various DeFi protocols. Through these platforms, users can easily bridge the gap between traditional cryptocurrencies and decentralized applications, without the complexities of interacting directly with DeFi protocols.

Benefits of the Convergence

The convergence of centralized exchanges and DeFi offers several advantages to both ecosystems:

a. Enhanced Accessibility: CEXs have well-established user bases, making DeFi services more accessible to a broader audience. This ease of access encourages more users to explore DeFi opportunities, fostering further adoption.

b. Improved Liquidity: DeFi platforms often face challenges with liquidity, but by leveraging the vast liquidity pools of centralized exchanges, DeFi protocols can experience improved trading and borrowing capabilities.

c. Regulatory Compliance: Centralized exchanges have already established relationships with regulatory authorities, ensuring compliance with local laws. This cooperation can help facilitate the integration of DeFi services within existing regulatory frameworks.

d. Enhanced Security: While DeFi protocols have made significant strides in security, centralized exchanges have robust security measures in place, providing an additional layer of protection for users’ assets when accessing DeFi services.

Challenges and Risks

Despite the potential benefits, there are challenges and risks associated with centralized exchanges becoming gateways for DeFi:

a. Counterparty Risk: By routing transactions through centralized exchanges, users reintroduce counterparty risk, as they must trust the exchange to execute DeFi-related actions.

b. Decentralization Concerns: The ethos of DeFi revolves around decentralization, and reliance on centralized exchanges might raise concerns about central points of failure and censorship.

c. Privacy and Data Security: While decentralized finance prioritizes user privacy, centralized exchanges often collect user data, raising questions about data security and potential misuse.

d. Regulatory Scrutiny: Regulatory complexities may arise as centralized exchanges integrate DeFi services, necessitating careful navigation of legal landscapes.

Conclusion

The convergence of centralized exchanges and DeFi marks a pivotal moment in the evolution of the cryptocurrency ecosystem. As CEXs evolve into gateways for DeFi, they play a crucial role in expanding DeFi’s accessibility and adoption. This trend has the potential to bring DeFi services to mainstream users and attract more liquidity to decentralized protocols. However, as this transition takes place, it is essential to address the associated challenges and risks, ensuring that the benefits of this convergence are realized while upholding the core principles of decentralized finance. As the crypto landscape continues to evolve, the interplay between centralized exchanges and DeFi will undoubtedly shape the future of the financial world.