Introduction:

In the world of cryptocurrency investment, exchange-traded funds (ETFs) have become increasingly popular vehicles for gaining exposure to digital assets like Bitcoin. Recently, Bitcoin ETFs have made headlines as they break a five-day outflow streak, signaling a potential shift in investor sentiment and renewed confidence in the cryptocurrency market. In this blog post, we’ll explore the significance of this development, its implications for the broader crypto landscape, and what it means for investors.

Understanding Bitcoin ETFs:

Bitcoin ETFs are investment products that track the price of Bitcoin and allow investors to buy and sell shares of the ETF on traditional stock exchanges. These ETFs provide a convenient and regulated way for investors to gain exposure to Bitcoin without directly owning the cryptocurrency itself. As such, they have become a popular option for institutional and retail investors seeking to diversify their portfolios with digital assets.

Breaking the Outflow Streak:

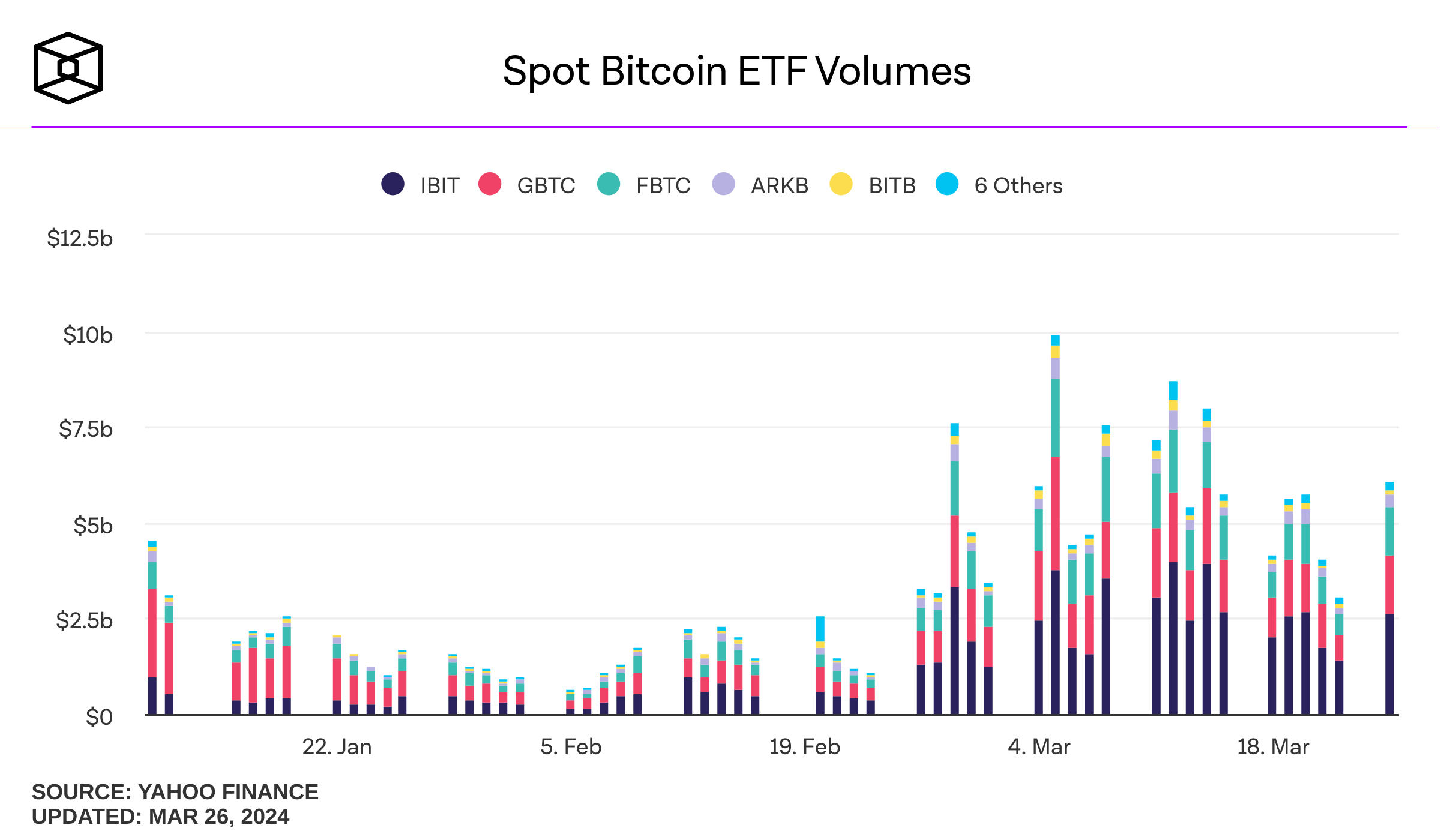

After experiencing five consecutive days of outflows, Bitcoin ETFs have rebounded with a surge in investor interest. This turnaround comes amidst a backdrop of renewed optimism in the cryptocurrency market, fueled by positive developments such as increasing institutional adoption, regulatory clarity, and growing mainstream acceptance of digital assets.

Implications for Investor Confidence:

The resurgence of inflows into Bitcoin ETFs suggests that investors are regaining confidence in the long-term potential of Bitcoin and the broader crypto market. Despite recent volatility and regulatory uncertainty, institutional and retail investors alike are recognizing the value proposition of digital assets as a store of value and hedge against inflation.

Market Sentiment and Price Dynamics:

The influx of capital into Bitcoin ETFs could have significant implications for the price dynamics of Bitcoin and the wider cryptocurrency market. Increased investor demand for Bitcoin ETFs may lead to upward pressure on prices as ETF issuers acquire more Bitcoin to meet investor demand. This influx of capital could potentially drive prices higher and catalyze further adoption and investment in the cryptocurrency space.

The Future of Bitcoin ETFs:

As Bitcoin ETFs continue to gain traction among investors, the future looks promising for the digital asset ecosystem. With growing regulatory acceptance and institutional participation, Bitcoin ETFs are poised to play an increasingly important role in the democratization of access to digital assets and the mainstream adoption of cryptocurrency investment vehicles.

Conclusion:

The breaking of the five-day outflow streak for Bitcoin ETFs represents a significant milestone in the evolution of the cryptocurrency market. As investor confidence rebounds and inflows into Bitcoin ETFs surge, the stage is set for continued growth and maturation in the digital asset space. With Bitcoin ETFs serving as a gateway for institutional and retail investors to access the cryptocurrency market, their resurgence signals a broader trend towards increased adoption and acceptance of digital assets as a legitimate asset class.

Disclaimer: This post is for informational purposes only and should not be construed as financial or investment advice. Readers are encouraged to conduct their own research and consult with a financial advisor before making any investment decisions.